California – The coronavirus epidemic is taking its toll on global financial markets. Last month, the stock market had its worst day since 1987, as the virus started bringing the economy to a screeching halt.

Alternative asset classes for the coronavirus epidemic

While the coronavirus has created substantial uncertainty in the major financial markets, markets for other assets have been far more stable. Three alternative assets emerged as asset classes that tend to perform well when equities markets are struggling; this is what was found:

Fine wine

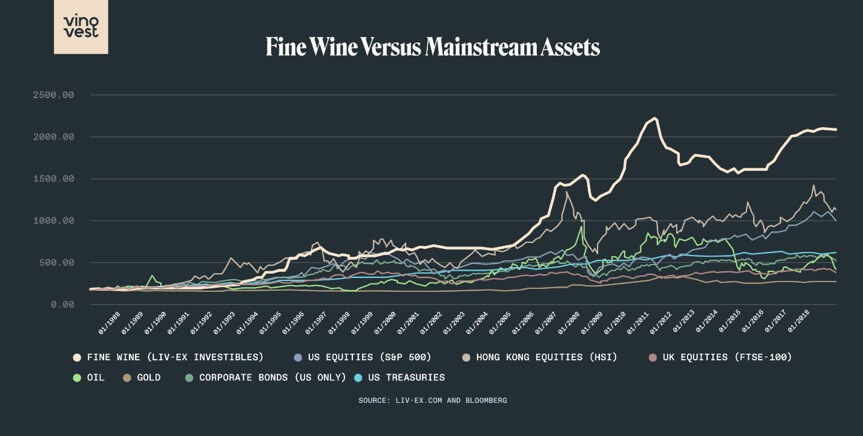

High-quality wine is one of the most promising alternative investments. The secondary wine market is currently worth $5 billion and is growing rapidly. According to the graph below, fine-wine stands head and shoulders above most mainstream assets.

This data shows that the rate of return for wine investors is 110% higher than S&P 500 index investors since 1988. The average rate of return isn’t the only reason to consider investing in wine over equities and other traditional financial assets–ambitious investors have far more opportunities to beat the market.

The market for most traditional assets is typically efficient because so many assets are bought and sold every day that the markets are open, and information is available nearly instantaneously.

On the other hand, wine investors can identify unique trading opportunities by doing their due diligence.

How to Invest in Wine

Many people looking to add wine to their investment portfolios find that Vinovest is the easiest way to gain exposure to this alternative asset. Vinovest allows users to buy/sell fine-wine and even stores the wine for these users so that they do not need to worry about having the proper temperature-controlled facilitate to guarantee the wine ages well. Vinovest even allows its users to withdraw the wine they bought if they wish to drink it, and can send the wine directly to the user’s house!

Gold

Gold is often called a safe-haven asset because it stays relatively stable during times of economic turmoil. That being said, gold is an excellent hedge against the risks of an economic downturn. One study found that it exhibits many characteristics of zero-beta assets, which means that it has about the same level of risk as treasury bills. In other words, it is one of the safest investments that you can make.

How to Invest in Gold

When it comes to adding gold to your investment portfolio, there are several approaches you can take. Buying physical gold in the form of gold bars and gold coins is often the best way to gain exposure to gold. However, it is not as liquid as investing in a gold stock like a gold ETF.

Bitcoin

Cryptocurrencies are another alternative investment worth looking into.

Bitcoin is often called digital gold because it has a finite supply–only 21,000,000 will ever exist–and is a deflationary currency. This means that as Bitcoin’s supply approaches its supply cap and as the U.S government prints more U.S dollars, that Bitcoin should become more valuable; this is because it is scarce, and because it is valued in USD, as the USD becomes worth-less as more of it is being printed.

How to Invest in Cryptocurrency

The easiest way to invest in cryptocurrency and own the digital asset yourself is through Coinbase. Coinbase is a digital currency exchange that allows you to buy/sell and hold many different cryptocurrencies. If you are just looking for price exposure to cryptocurrency and are not interested in holding and managing the digital assets yourself, Robinhood is a great option. Robinhood will give you price exposure to Bitcoin without requiring you to set up a cryptocurrency wallet that is capable of safely storing Bitcoin.

When Will the Economy Get Better?

The future of the economy is highly uncertain. Many experts believe that some form of social isolation will need to continue for at least 12-18 months. That being said, investors should hedge against this uncertainty by leveraging alternative assets like fine-wine, gold, and cryptocurrency.