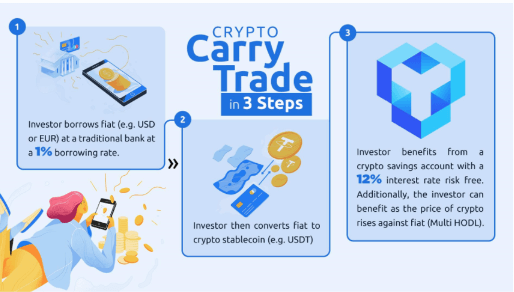

Recently, a Swiss company called “YouHodler” “provided an opportunity for users to create an account with an annual return of 12% for stable-coin savings account and profit.

Currency-carrying trade is a strategy that states that the trader will convert between a high-yielding currency to a low-yielding currency. The trader who uses this strategy gets his profit through the difference between converting rates for both currencies, and these differences can be huge, depending on the amount of leverage used. For example, let’s say rates in Japan are 0.1 percent and rates in Mexico 6.5 percent. This means the trader profit expected to be 6.4 percent, which is the difference between the two rates.

How the crypto carry trade work

YouHodler, for example, has paid up to 12% annual interest on stable-currency deposits. This interest is done through loans supported by cryptocurrencies, which provided to “HODLers” and crypto traders. As the interest of ordinary banks continues to decrease, this crypto trading strategy is a viable option for crypto traders to take advantage of the new digital economy and the big profits.

The crypto carry trade is not a replacement for traditional trading on the stock market

The crypto carry trade is not a replacement for traditional trading on the stock market, and crypto-fiat FinTech platforms are not a replacement for traditional banking institutions. Stocks can still be a profitable investment. (e.g., Tesla going up 36% in two days). This new blockchain technology is looking to give new solutions to avoid errors and problems presented by traditional banking solutions and does not aim to replace the current economic system at the same time but is keen to link the past to the future through this promising technology to provide more flexible and realistic solutions with high profit for all the people of the world.

Banking interest rates have continued to fall since the Great Recession, and they look to be staying that way.

European banks follow a negative interest rate policy (NIRP) that requires financial institutions to pay interest to maintain additional cash reserves within the central bank. For example, the Swiss National Bank first introduced negative interest in 2015 and now has the minimum rates in the world at about -0.75%

Moreover, banks following the NIRP program are unlikely to reverse their policy anytime soon, as financial analysts predict unpleasant prospects for the global economy in the coming years. Interest rates are at an all-time low and may drop further soon. Consequently, the attractiveness of deposits based on high-yield cryptocurrencies is increasing, and the preservation of cryptocurrencies is preferred every day.

More details can be found at: https://www.youhodler.com

News Source: StartupFortune.com