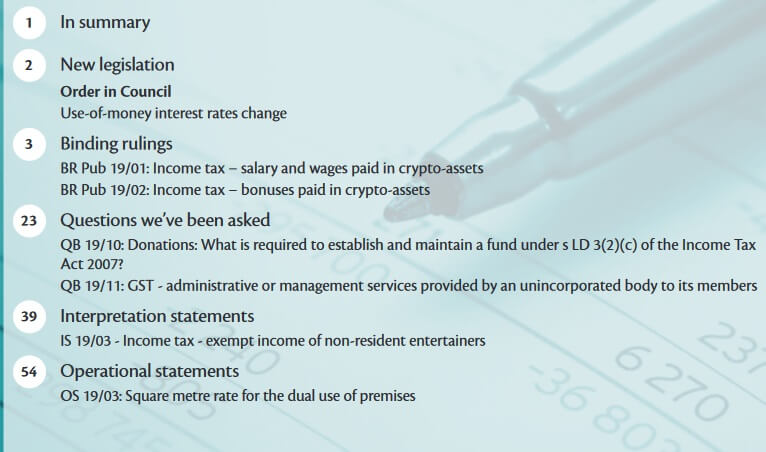

In an official ruling, the tax authorities in New Zealand declare that paying in bitcoin for wages or salaries is legally binding. The tax department clarifies the legality of paying employees in Bitcoin (or any other cryptocurrencies) and how it should be handled on an accounting level. However, as an independent entrepreneur, you cannot use this. The notice also contains more information about taxes and refund.

The official document of the ruling can be found here: https://www.classic.ird.govt.nz/resources/1/c/1c6029d0-611c-4a15-9cbf-b712129ab76c/tib-vol31-no7.pdf

The change is effective as of August 29. It includes a special treatment for the income tax of cryptocurrencies. From that moment, cryptocurrencies are accepted in the larger image of the income tax. Another term for this is the tax Paye what you earn. The argument given by the tax authorities is that it is increasingly normal for employees to be paid in cryptocurrencies. Of course, this is the case in the industry related to cryptocurrencies, but also abroad it seems to be increasingly conventional.

The ruling states that you can make a payment in crypto currency in two ways. The first way is to deduct the gross salary or the employee’s salary and the second way is to reduce the gross profit.

All of that may sound a bit vague. To illustrate, the tax authorities have added an example to the resolution: If a person earns NZ $ 10,000 in salary per month. Half of this goes to his or her bank account in NZD and the other half is sent to a bitcoin wallet. The tax is calculated on these NZ $ 10,000 gross and subsequently withheld and paid.

If the person is in a situation to claim a child benefit or a student loan deduction, then this is a tool that can be used to calculate exactly how much and how the payment should be made. The manual for this can be found on the website of the tax authorities.